It’s been a few days since the fire rating was released, and, as usual, the elected officials and bureaucrats who wanted the tax to pass ran to the nearest news cameras to say “see, I told you so.” However, much like the move to pass the tax, the information being put into these media reports is long on emotion and short on facts. Unfortunately, the news media is limited to what they’re presented with, and really dont’ have time to do much research. That’s why Citizens for a New Louisiana is here to help.

It’s important to know that, as in a game of golf, the lower your score the better you’re doing. Back in 2014, the fire rating report for the unincorporated parts of Lafayette Parish was five. The same elected officials that voted to cut the fire budget by 25% told you there simply wasn’t enough money to provide good, quality fire service. If you didn’t pass the largest singe tax increase in parish government history, the fire rating was going to get worse. Two months after their tax failed, the new score was released at a six.

The news report, an account of what the elected officials and bureaucrats said happened, has a few interesting points that are important. So let’s review that first.

First, “December’s tax proposition would have fixed the issues with fire protection in the parish.” That quote is a little misleading. How does a tax fix anything? It doesn’t. We can all agree that governing authorities fix things by spending money, not collecting money. That being the case, according to the quoted “experts” in the article, what things caused the fire rating to go from five to six that the tax would have fixed?

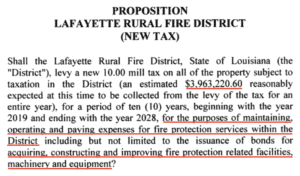

1. “Not having adequate water.” When something is listed first, it’s safe to assume it’s the most important issue. While we’ll get into this one in more depth in a bit, it’s important to remember the ballot language of the tax. Were voters presented with a solution to this number one problem at the December ballot? The short answer is “no.” Let’s have a look at the ballot language.

A quick read tells us all we need to know. Supplying water is not a part of the ballot language, so the tax would not have addressed the number one reason the fire rating changed.

A quick read tells us all we need to know. Supplying water is not a part of the ballot language, so the tax would not have addressed the number one reason the fire rating changed.

2. “Not having stations in the right locations.” If we think back to the old Comprehensive Plan days, LCG spent some $25 million on planning where everything was supposed to go. Here we are, years later, and nothing is in the right places? It’s possible that the fire houses were built before the comprehensive plan, but it’s a stretch to say that passing a tax would magically relocate buildings that are strategically in the wrong places.

3. “Not having the number of stations available to provide fire protection.” This one seems to be the most legitimate thing that the fire tax could have addressed. After all, the ballot language does say it will pay for construction for fire protection related facilities. However, fire stations take a long time to plan and build. If the tax had passed two months ago, today there would not be a single new fire station, so the rating would still be a six. This one, while a valid item to improve the fire rating in the future, would not have magically made the fire rating a five.

Another thing worth noting is there was no plan to build fire houses. Back when the fire tax was being proposed, there were several town hall meetings. After the presentation, during the question and answer part of the meeting, I asked where they planned to build new fire stations around the parish. The answer was, there was no written plan to build fire stations.

So, for all three of the reasons that the unincorporated parts of Lafayette Parish lost their fire rating, none of them would be fixed by the tax – at least not in time to avert the higher rating. I also reached out to the reporter who wrote the story to find out if she had a copy of the fire report. She did not. We made a public records request to the PIAL to get a copy, but after three days of no-response, it can be assumed that the PIAL is a private association that doesn’t fall under the public records law. Fortunately, the folks at the fire station next door were very helpful and provided the 2019 and 2014 reports.

What do the documents say?

This is always our first question. After all, it’s one thing to ask someone who wants you to pay more taxes, but something entirely different to look at the documents for yourself. If you’d like to check them out, feel free to download the 2014 and 2019 reports and follow along. It will be important to know that the 1-10 rating system is based on a 0-100 point scale, as follows.

| CLASS | Credit Earned |

| 1 | 90 or more |

| 2 | 80 to 89.99 |

| 3 | 70 to 79.99 |

| 4 | 60 to 69.99 |

| 5 | 50 to 59.99 |

| 6 | 40 to 49.99 |

| 7 | 30 to 39.99 |

| 8 | 20 to 29.99 |

| 9 | 10 to 19.99 |

| 10 | 0 to 9.99 |

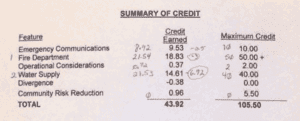

In 2014, the unincorporated parish received a 50.85 score and a rating of 5. The 2019 report attained a score of 43.92 and a rating of 6.

The last page of the 2019 report is a summary, which I’ve included below with my own notes. 2014 doesn’t have a summary, so you’ll have to line up the numbers and do your own arithmetic (or just use mine).The penciled in numbers represent changes from the previous report.

The two main losses from 2014 were “Fire Department” and, the single-largest loss, “Water Supply.” The Fire Department section’s main loss was in personnel.

The two main losses from 2014 were “Fire Department” and, the single-largest loss, “Water Supply.” The Fire Department section’s main loss was in personnel.

We haven’t received a return call from the PIAL on why increasing personnel from 263 to 285 would reduce the rating from 4.1 to 1.8 of a possible 15. If we extrapolated the current score agains the number of employees, to achieve a maximum score of 15, it would require having 2,375 on staff! Another single point lost here was relevant to “proving apparatus response times.” Without talking with the PIAL, we can only assume it’s a reporting issue.

“Water Supply” was the main loss of seven points, and it was not addressed by the fire tax. Those seven points are more than enough to get back to an overall rating of five. If you want to see the detail of various water flow tests, they ca be found in the first few pages of the 2019 report. The resolution, also listed in the report, is four-fold. 1. Design and install a water system capable of supplying standard fire hydrant flows. 2. Install standard fire hydrants within 1,000 feet of structures. 3. increasing pumping capacity during Water Hauling operations. However, section 532 has already awarded the district the maximum 3 points for pumping capacity. 4. Develop additional, alternate water supplies for areas without hydrants.

Now to a very important question. Where else can you find details about this fire rating? Nowhere. Citizens for a New Louisiana and Lafayette Citizens Against Taxes are the only ones looking at the public records and bringing you this vitally important research. It simply isn’t available anywhere else. If you believe this work is important, please consider volunteering or becoming a financial supporter.

There are many state-wide organizations that work hard to bring you information about state government issues. How many are there that do any research on a local level? We’re the only organization that’s focused on explaining parish-level issues. If you’d like us to do more research and expand to other nearby parishes, we can only do that with your financial support.

###

Trackbacks/Pingbacks