On Tuesday, September 1, 2020, the City and Parish Council agendas include unprecedented tax increases of around eight-percent (8%). What makes this unique isn’t the amount of the increase, but that, for the first time in the history of the Lafayette councils, they could actually authorize taxes be levied at a higher rate than the voters have approved. That rate is listed in the “AUTH RATE” column of the legislative auditor’s maximum millage report.

This unique scenario is created when the value of taxable property is less than it was the year before. If the taxing authority levied the same percentage rate against lower valued property it could bring in less revenue than the year before. The “fix” should be for government to cut expenses and live within its means. That’s what families and businesses have to do when their income is reduced – and it’s going on at nearly every kitchen table in Lafayette. Instead, the government’s solution is to make you cut your expenses so you can pay it more.

What happened?

Simply put, legacy lawsuits and the governor’s emergency orders have combined to stun state and local economies to the point of recession. This news of a six-percent (6%) reduction of our local economy comes to us at the hands of Lafayette’s tax assessor, Conrad Comeaux. He’s been appearing at budget hearings at LCG for years, lamenting the amount of taxes that greedy area residents and businesses don’t have to pay. He always encourages the council to tax everyone at the maximum rate allowable by law. This technique exclusively benefits local government to the detriment of the economy, families, and small businesses.

Every year, like clockwork, Mr. Comeaux explains that the general alimony tax revenues (that aren’t limited to a specific purpose) were reduced years ago and can never be increased unless the economy shrinks. During his tenure as assessor, and as a direct result of his testimony, Lafayette’s taxes are set to the maximum amount allowed by law.

This year, thanks to John Bel Edwards legacy lawsuit and coronavirus mandates, the value of commercial property is down from last year. However, residential property hasn’t had any significant value change. That means this tax increase will exclusively hit residential property (or commercial property that serves residential purposes) and every resident and family that has to pay a mortgage or rent.

The PARISH ordinances that raise taxes without voter consent

In the parish, the ordinances are PO-039-2020, addressed in this article, PO-040-2020, upgrading the airport millage from 1.71 to 1.83 mills, and PR-012-2020 that upgrades the LEDA millage from 1.68 to 1.8 mills.

In the parish, the ordinances are PO-039-2020, addressed in this article, PO-040-2020, upgrading the airport millage from 1.71 to 1.83 mills, and PR-012-2020 that upgrades the LEDA millage from 1.68 to 1.8 mills.

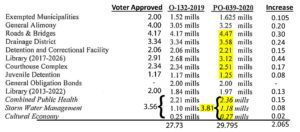

The differences between this year’s PO-039-2020 and the previous year’s O-132-2019 are listed in the accompanying graphic. Remember, these aren’t dollar values, but a percentage of your property’s value. To convert the millage to a percentage, move your decimal three spaces to the left (divide by 1,000). Last year, the total for the first ordinance was 27.73 mills or 2.773% of your property’s value. This year, that amount increases to 29.795, or 2.9795%.

A few councilmen are already out talking about how insignificant these numbers are. However, if they were insignificant, then why does the councilman want to increase them at all? Also, remember that this is just a small fraction of your overall property tax picture. Last year, the ordinance contributed 27.73 mills (2.8%) to the parish’s total 84.44 mills (8.4%). That also doesn’t include city taxes.

The CITY ordinance that raises taxes without voter consent

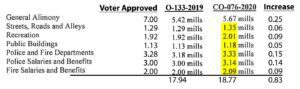

There’s only one ordinance that addresses property tax millages in the city. It’s CO-076-2020. If you’d like to check my math, you can reference the previous year’s O-133-2019. The accompanying graphic explains that the city taxes aren’t jumping quite as far as the parish. However, it’s still an increase of 4.6%.

There’s only one ordinance that addresses property tax millages in the city. It’s CO-076-2020. If you’d like to check my math, you can reference the previous year’s O-133-2019. The accompanying graphic explains that the city taxes aren’t jumping quite as far as the parish. However, it’s still an increase of 4.6%.

Adding in “other” millages could total 118 mills or 12%!

Combining the city, parish, and other taxing authorities in the parish that also contribute to the overall millage picture paints a more complete picture. If these other taxing authorities don’t increase their millage over last year (which is highly unlikely), your new property tax will be around 86.745 mills (or 8.7% of your property’s value) in the parish, or 104.685 in the city of Lafayette. If your property is in the Commercial Core Subdistrict (which is operated by the Downtown Development Authority, or DDA for short), your ad valorem tax will be 118.265, or about twelve-percent (12%) of your property’s value.

The other millages which we don’t have a clear picture on just yet include the following. For comparison, I’ll include last year’s millage levy.

- Teche Vermilion District 1.41 mills

- Tax Assessor 1.56 mills

- Sheriff’s Law Enforcement District (1985) 8.03 mills

- Sheriff’s Law Enforcement District (1977) 8.76 mills

- School District Regular 4.59 mills

- SCHOOL DIST NO 1 (2017) 7.27 mills

- SCHOOL DIST NO 1 (2012) 5.00 mills

- SCHOOL DIST NO 1 (2015) 16.7 mills

- Commercial Core (DDA) 12.75 mills

The total of these extra ad valorem taxes is 66.07 mills. If we assume they’ll also increase themselves by seven and a half percent (7.5%), that’ll create a new total of about 71 mills – or 5 mills more than last year. After all of the taxing authorities return to the taxpayer trough for more money, we’ll have gone from 84 mills to 101 mills in the parish alone! Adding in the city’s millages get us to about 120 mills, or twelve-percent (12%) of your property’s value. Let your councilman try to call that insignificant.

Constitutional loopholes make it possible

According to the Louisiana Constitution, Article VII, Section 23 (A), as property values shift, local government should “adjust millages upwards or downwards without regard to millage limitations contained in this constitution, and the maximum authorized millages shall be increased or decreased, without further voter approval, in proportion to the amount of the adjustment upward or downward.”

This is typically performed once every for years in a re-assessment year (which was last year). However, the constitution, Article VII, 18(F)(1) says they may reappraise property taxes any time they want to, so long as it’s at least once every four years.

Will tax percentages drop next year if values go up?

In short, no. Article VII, Section 23 (A) goes on to explain, “Thereafter, such millages shall remain in effect unless changed as permitted by this constitution.” In other words, if enacted, this eight-percent (8%) increase becomes permanent.

What can you do?

There are several things you can do to let your councilman how you feel about these tax increases. The more people that do all of these things (not just one or two) the more likely your councilman is to listen.

- Email the council office at DoNotSpeakCM@lafayettela.gov

- Call the council office at (337) 291-8810 and tell them you oppose parish items 6, 10 & 11, and city item 11, which raise property tax millages beyond what the voters have approved.

- Email your councilman (city and parish if you have both)PARISH Click here to email the entire parish council at once. You can also email them individually by clicking on their email address below.

- Bryan Tabor bryantabor@lafayettela.gov or (337) 291-8801

- Kevin Naquin kevinnaquin@lafayettela.gov or (337) 291-8802

- Joshua Carlson joshcarlson@lafayettela.gov or (337) 291-8803

- John Guilbeau johnguilbeau@lafayettela.gov or (337) 291-8804

- AB Rubin abrubin@lafayettela.gov or (337) 291-8805

CITY Click here to email the entire city council at once. You can also email them individually by clicking on their email address below.

- Patrick Lewis patricklewis@lafayettela.gov or (337) 291-5101

- Andy Naquin andynaquin@lafayettela.gov or (337) 291-5102

- Liz Hebert lizhebert@lafayettela.gov or (337) 291-5103

- Nanette Cook nanettecook@lafayettela.gov or (337) 291-5104

- Glenn Lazard glennlazard@lafayettela.gov or (337) 291-5105

- Call your councilman at the above listed number (city and parish if you have both)

- Show up on Tuesday and fill out a “blue card.” You should stick around and speak, but you don’t have to. To fill out a card, simply show up any time from about 4:30pm until the city council adjourns and look for the public comment table (usually on the left). As long as you get there before the ordinances are heard, your “blue card” will be counted.

- If you’re unable to show up, or prefer to call your comment in, tune into the council meeting online at http://www.ustream.tv/channel/lafayette-consolidated-government-council-meeting on on Acadiana Open Channel on your TV, and call as soon as the parish meeting is called to order – then again when the city meeting is called to order. As long as you call before the item comes up in the agenda, you should be allowed to speak. For the parish council meeting, the agenda item numbers are 6 (for leda), 10 for the long list of millages, and 11 for the Airport millage. The city agenda item number is 11. The number to call is (337) 291-8428.

###

We’re the only organization holding them accountable.

Our deep research takes a tremendous amount of time and resources. After reading this article, you can probably understand why the government isn’t funding our work. In fact, they probably wish we’d just go away. That’s why we depend on the generosity of concerned citizens like you.

We’re seeing a record number of new monthly contributors and one-time donors. These are people just like you. They’re tired of the local news constantly regurgitating government press releases, pushing higher taxes and lower expectations. Are you one of them? Join us now.

Trackbacks/Pingbacks