Lafayette Parish Jail Tax

- Lafayette Parish Jail already has two ad valorem taxes on the books.

- This tax proposal is a 158.9% increase

- The new tax would bring in more than double the current expenses

- Last year, existing dedicated taxes provided $2.5 million more than needed

- The account surplus has increased 723.4% over ten years to $7,815,088

The Details:

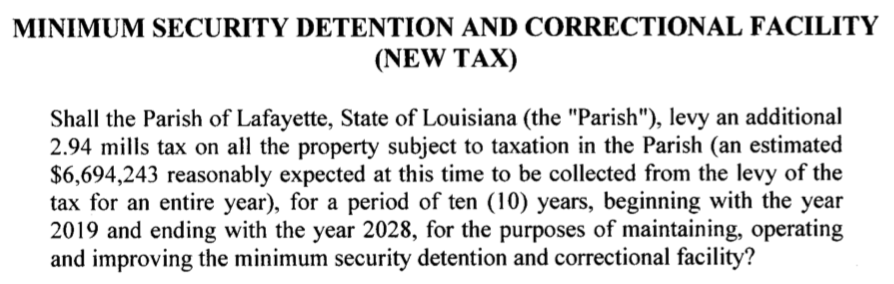

This November, Lafayette voters will be considering a brand new tax for the Lafayette Parish Jail. In the ballot initiative, Lafayette Consolidated Government is asking voters for an additional $6.74 million in new, annual taxes to add to the $4.7 million1 we just approved last November. For the moment, let’s set aside the $5.3 million Courthouse & Jail Complex2 tax we also just approved last November.

A quick glance at last year’s financial report2 shows the jail required $4,950,148 to operate but only collected $4,211,369 in property taxes. The argument being used to raise your taxes is we must cover this deficit of $738,799. However, the proposal from the Lafayette City-Parish Council asks you to raise your taxes by nearly $6 million more than the jail needs.

One of the things that makes this new tax questionable is the “deficit problem” it purports to address is already being handled the Courthouse & Jail tax2 we set aside a moment ago. Over the last five years, that tax brought in an annual average of $1.8 million more than the Courthouse needed to operate. To reconcile the shortage of the Parish Jail tax1, a portion of the Courthouse & Jail surplus was used. This isn’t a problem, though, because the title “Courthouse & Jail tax” tells us it’s supposed to help fund the Parish Jail.

All the council proposal is supposed to do is eliminate the need for the Courthouse & Jail millage to transfer any funds to the jail. However, it not only more than doubles the $4.4 million tax currently being collected but it also generates more than double of what the jail needs to operate. That makes enough of an annual surplus to operate two identical jails with money left over.

Even with the jail showing a consistent annual loss on paper, since 2008 the combined account balances of the Courthouse and Parish Jail have grown 723.5% to $7.8 million3. If we stopped collecting all taxes today, that surplus could still fund the courthouse and jail for an entire year. Adding the proposed new tax to this formula could see that surplus grow to $17 million by next year! To put that into perspective, the three-story library downtown only cost taxpayers $10 million to rebuild.

A good look at the numbers reveals this tax as presented on the November ballot doesn’t fix a problem. Rather, it creates a question: what are they planning to do with a $10 million annual surplus?

- 2.06 mills under Correctional Center, Page 30, LCG 2017-18 Budget

Adult Correctional Facility Maintenance, Page 144, 2017 Comprehensive Annual Financial Report (CAFR) - 2.34 mills under Courthouse Complex, Page 30, LCG 2017-18 Budget

Courthouse and Jail Maintenance, Page 145, 2017 Comprehensive Annual Financial Report (CAFR) - Page 145, 2017 CAFR, Page 136 2008 CAFR

- LCG Resolution R-032-2018 (ballot language included above)

The combined Correctional Facility, Courthouse & Jail spreadsheet above includes trend estimated numbers for 2018 and 2019. The proposed $6,694,243 in new taxes is not included.

Trackbacks/Pingbacks