Six times they tried to raise taxes. Six times voters said, “no.”

- Do you remember the School Tax? Back in 2017, the Lafayette Parish School Board decided it needed $238 million in tax revenue to build a bunch of schools. The voters said, “no.”

- How about the Library tax in 2018? That’s when they tried renewing their third “temporary” tax even though they had a $42.3 million surplus. The voters said, “no.”

- Then the LCG council wanted to create a third property tax for the jail. Turns out there was a $10 million surplus in that fund, too. The voters said, “no.”

- Remember when the Sheriff wanted to re-arrange his tax to increase his revenue another 50%? The voters said, “no.”

- Remember when the LCG council tried to create a new fire tax? The voters said, “no.”

- Purvis Morrison tried to add a new sales tax to the City of Scott. Not only did voters say, “no,” but they even removed Purvis from office!

Don’t Tax You. Don’t Tax Me. Tax That Fellow Behind the Tree

Around here, the government hasn’t been able to raise taxes. That’s because, in Louisiana, local governments must seek the people’s approval. Sometimes the people say yes, such as during the airport tax debate. However, the purpose of that tax was a well defined and it expired in just a few months.

Around here, the government hasn’t been able to raise taxes. That’s because, in Louisiana, local governments must seek the people’s approval. Sometimes the people say yes, such as during the airport tax debate. However, the purpose of that tax was a well defined and it expired in just a few months.

Lafayette’s Home Rule Charter, Article II, Section 2-17 D says, all proposals to levy a new sales tax shall be submitted to the voters for approval. Yet, six new sales taxes are being proposed in such a way that the people’s approval may not be required.

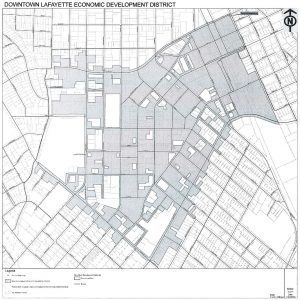

For now, let’s look at just one of them. There are two ordinances associated with the downtown development district: O-225-2019 and O-226-2019. The map comes from the first one, and looks something like a slice of Swiss cheese. The holes represent places where voters may be present. If no voters are included in the district, as the theory goes, the government wouldn’t have anyone to ask for approval. However, that theory isn’t perfect, as we’ve noticed several locations that aren’t included couldn’t possibly have any voters. One such location is the old, abandoned AOC building that’s currently fenced off.

What’s the goal of all this?

This whole scheme is a series of devices strung together in such a way that they accomplish a certain goal. The casual observer may think the plan here is to raise taxes on people without their consent. While that’s one of the components of the plan, the tax is not the end goal. It’s merely a vehicle to get there.

What they’re really after is a large line-of-credit to hand over to a developer. Some of the taxing districts include the developer’s name. However, the downtown district names DDA (the Downtown Development Authority) as the beneficiary – shielding the developer from public scrutiny.

The DDA tax will last twenty-five years (some other districts are forty-years), and is expected to generate $700,000 in the first year. That revenue estimate is not included in any of the paperwork, by the way. However, it was mentioned by DDA’s executive director, Anita Begnaud, at the November 19th council meeting. If we apply simple math and multiply $700,000 by 25-years, it works out to $17.5 million in total revenue. Sales tax is fickle, but it may be reasonable to assume inflation over twenty-five years could reasonably expect them to pay back a $20-25 million bond. If we take the lower number of $20 million, and assume that for all six districts, we’re looking at around $120 million in bonding capacity.

Bonds are debt – like a mortgage

This won’t be the first time Lafyette has written a bond. In fact LCG has borrowed $815,138,367, as of the 2019-2020 budget (page 287). In fact, next year, LCG will have to make $69,874,556 in payments. However, last year they borrowed another $84,135,000 that we know about. It’s actually possible that they’ve borrowed even more in 2019 that they’re not telling us about. Bond issues from 2018 didn’t show up until 2019’s budget document. According to the 2019-2020 budget, (pages 289 and 290) they borrowed $38,755,000 in 2018 that did not show up in the 2018 budget!

Now they’re creating new bonding vehicles to put Lafayette even further into debt just to pay private land developers to build new hotels and restaurants? It doesn’t make sense from an economic standpoint.

If I don’t sell retail – this tax doesn’t affect me

I spoke with a business owner last week who explained that he didn’t think the TIF tax in his area affected him. He thought this because his business didn’t collect sales taxes. However, after it was too late, he realized the tax affects his bottom line in a different way. If your business is located in the district, you will have to pay the extra tax any time something is delivered. Vehicles are an especially egregious example of the problem. They are among the most expensive equipment purchased by any business. That business owner found this out the hard way.

###

We’re the only organization holding them accountable.

Our deep research takes a tremendous amount of time and resources. After reading this article, you can probably understand why the government isn’t funding our work. In fact, they probably wish we’d just go away. That’s why we depend on the generosity of concerned citizens like you.

We’re seeing a record number of new monthly contributors and one-time donors. These are people just like you. They’re tired of the local news constantly taking the side of government, pushing higher taxes and lower expectations. Are you one of them? Join us now.

Trackbacks/Pingbacks