Four things you need to know about the fire tax

1. How to calculate how much 10 mills means to you. We can make this a whole lot simpler than all the crazy calculations some council members have been providing. First, you’ll need your latest property tax bill. It should have just arrived in your mail box late last week or earlier this week. If you add up all of the taxes, they’re probably in the neighborhood of 85 mills. Adding 10 mills to it means a 12% overall increase in your property taxes. The calculation is simple. Take the bottom-line from your current tax bill and multiply by 0.12. That’s exactly how much this tax would have cost you personally if it had been on this year’s tax bill.

2. An urban legend started by some council members, fire chiefs, and other tax-us-to-death enthusiasts is the unincorporated parts of the parish do not pay a dedicated tax for fire, and that’s simply unfair to other people. As it turns out, that’s not the case at all. For proof, we turn to pages 162 and 52 of the 2018-19 proposed budget. Page 162 shows us the Parishwide Fire Protection expenses. You’ll see “2%” behind about half of the entries. That’s referencing the 2% Fire Insurance Premium Tax that appears at the top of page 52. That fire tax is funded by taxing 2% of your property insurance premium. More information on the program is available on the state government’s website under Revised Statute 22:345 and 22:347. That fund provides over $1 million of dedicated money for fire protection, which trickles down to the parish government. Yes, if you are in the unincorporated parts of Lafayette parish and you pay for property insurance, you are already paying a dedicated fire tax worth over $1 million.

3. The other urban legend is this $4 million tax will save $1.6 million that is desperately needed in the parish general fund. Again, this is simply not true. As we mentioned in #2, over a million dollars that’s being provided to the parish general fund is dedicated for parish fire protection and can’t be used elsewhere. What’s left is only about $590,000. While it’s true that anything is better than nothing, it’s a far cry from the salvation they’ve been claiming it is.

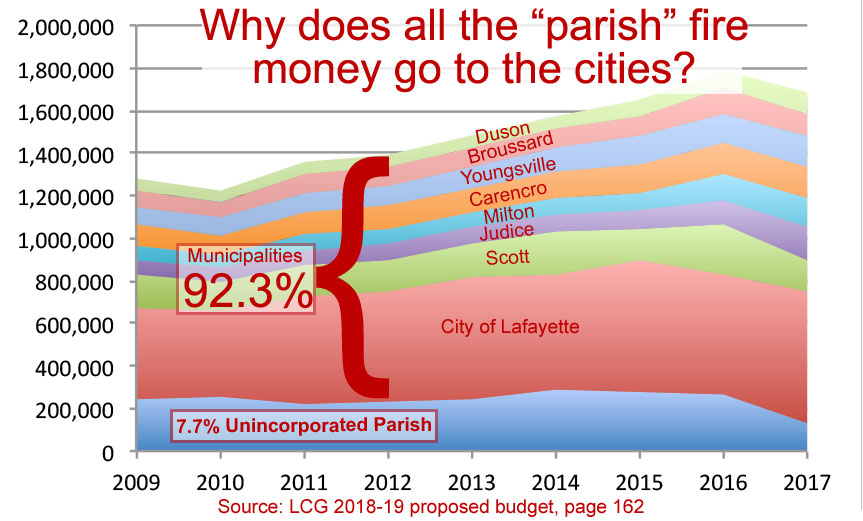

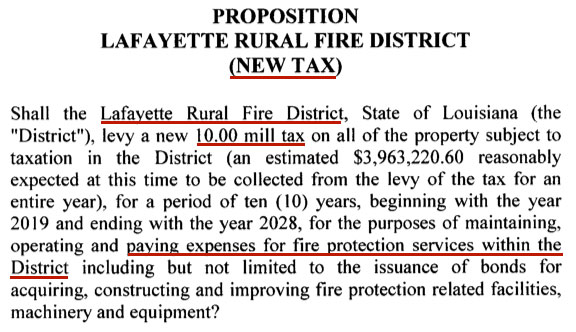

4. It’s for the parish! The tax will be levied against property in the unincorporated parts of the parish “for the purposes of maintaining, operating, and paying expenses for fire protection services within the [un-incorporated fire protection] District…” That quote comes directly from the ballot language. It would lead any reasonable person to conclude that any money drawn from this district will be used exclusively to improve the fire rating “in the District.” However, back on page 162 of the budget it clearly states that 92% of all money that’s currently “dedicated” for the unincorporated parts of the parish go to the cities. If this tax were to pass, that means the cities will get to use $5 million parish dollars to improve their municipal fire departments!

Trackbacks/Pingbacks