The sheriff's 50% tax increase

and that pesky $17 million surplus- The 1/2 cent “reduction” increases taxes 50%, from $42 million to $63 million per year.

- In 2017, the Sheriff’s Office reported a $17 million surplus.

- Proposed change would INCREASE taxes in ALL municipalities by 1/2 cent.

- Increases money collected inside municipalities $24 MILLION.

- Supplemental pay for municipal police only returns 7% to the municipalities it came from.

- If passed, the $26 million tax would be permanent.

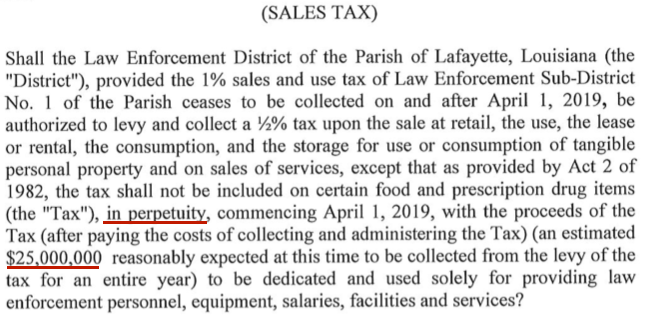

The Lafayette Parish Sheriff’s Office has been presenting the December 8th tax proposal as a “reduction.” Even the ballot’s tricky language would lead any reasonable person to believe that it would lower the amount of taxes being extracted from the local economy. However, that’s simply not the case. The rate would go down in the dwindling unincorporated parts of the parish but up everywhere else. The net effect means the $5 million that’s currently being collected will become $26 million. That $21 million difference has to come from somewhere. That somewhere is the local economy. (The School System, which collects all sales taxes in the parish, revised their estimate for this tax from $25 million to $25.7 million.)

Overall, the law enforcement district taxes on property and sales totaled $42 million last year, $37 million from property and $5 million from sales. If we replace that sales tax number with the $26 million being proposed, the total taxes collected ends up being $63 million. That would generate a 50% tax INCREASE for the Lafayette Law Enforcement District. A fifty-percent increase!

We’ve become accustomed to having taxes come up every ten years for renewal. Considering that bureaucrats spend tax money like they’ve won the lottery, ten-years is probably not often enough. The ballot language for this sales tax, however, says it lasts “in perpetuity,” or forever. A “yes” from a majority of voters means this tax lasts forever and will never be called to the ballot again.

What about that $17 million surplus?

If you’d like to follow along, most of what we’re covering can be found in the Sheriff’s 2017 audit on the page marked 51 (page 53 in the PDF.) The top two lines are Ad Valorem (property) and sales taxes. For a little perspective on how things have changed over time, you should review the 2008 audit (page 21). If you’d like to review more of the annual reports, we’ve made them available for your perusal.

The Sheriff’s 2017 audit shows a $17,313,710 fund balance. It has been argued that it’s just a snap-shot because the Sheriff’s Office only gets paid property taxes once a year. $17 million is far less than the $65 million it costs to operate for an entire year, so they need to borrow money to make ends meet. While that’s true, property taxes only represent about half of their overall income. If any money is borrowed, the property taxes come in early in the year allowing them to pay off any loans quickly. Many businesses and government organizations operate the same way.

Looking back, we can see the sheriff is indeed a good steward. Last year he added $1,562,365 to 2016’s $15,751,345 fund balance. That’s the first time anyone has increased the fund balance since 2010. If we assume that the $5 million in savings listed in his presentation (page 6) is accurate, he could potentially be depositing that money toward growing his fund balance. Doing so would make it around $22 million for 2018 and $27 million in 2019.

The 1/2 cent tax increase for municipalities would generate 92% of all revenue.

Page ten of the sheriff’s presentation lists the single benefit that has many municipal law enforcement personnel (outside the City of Lafayette) supporting such a substantial tax increase. That is, the Sheriff is offering them a $250 – $500 per month pay raise. However, upon close scrutiny, the amount raised inside the municipalities dwarfs the subsidy. We were curious to know how the numbers break down, so we extrapolated a percentage based on similar sales taxes collected in the municipalities and unincorporated parish. All told, the calculation is reasonably close to the School System’s 1965 1% parish-wide sales tax, so this chart should be pretty close. Our detailed analysis is included as a spreadsheet toward the bottom of the article.

Right now, the Sheriff collects a whole cent in sales tax in the unincorporated parts of the parish. No money is collected inside any city limits. The new proposal would reduce the rate to 1/2 cent in the unincorporated parts of the parish by adding that 1/2 cent back in to city collections. With that change, $19 million will be collected inside the City of Lafayette alone – that’s 73% of the entire tax. The Sheriff is proposing to return $1 million of the $19 million collected to the City Police. That’s only 6.5% of what’s raised inside the city! Is it any wonder the Lafayette City Police are opposed to this tax increase? The scenario works out similarly in the other municipalities, but not nearly on the same scale.

The unincorporated parish is where the Sheriff deputies patrol, so it made good sense to set up the sales tax that way back in 2002. However, as the unincorporated parts of the parish shrink, the tax revenue also shrinks. In the last ten-years, it has decreased by about 33%. However, property taxes, which have always been the lion’s share of his tax revenue, have grown 91%. The numbers work out to sales tax shrinking $2.3 million but property tax growing by $17.8 million. The Sheriff’s Office has netted $15.5 million MORE revenue over that time, not less.

Sheriff Municipality Payout

The “current rate” and “new rate” columns represent how total sales tax will change if this tax proposal is approved by voters. The remaining columns are specific to the Sheriff’s 1/2% proposal. The “Paid local” column represents the amount paid of the tax that was collected in the same city. The “Paid total” column represents the amount paid out of the total tax.

###

Trackbacks/Pingbacks