Jettisoning the Buchanan Garage

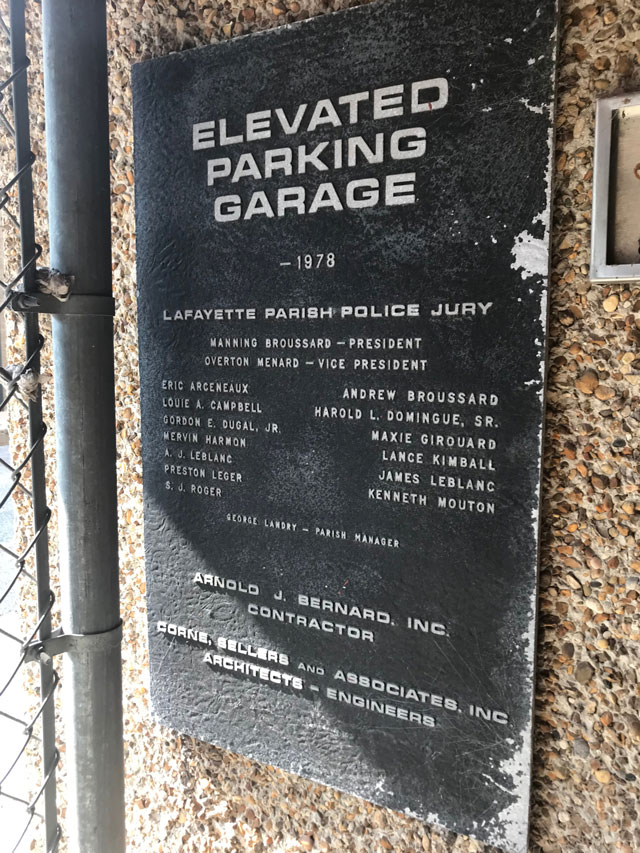

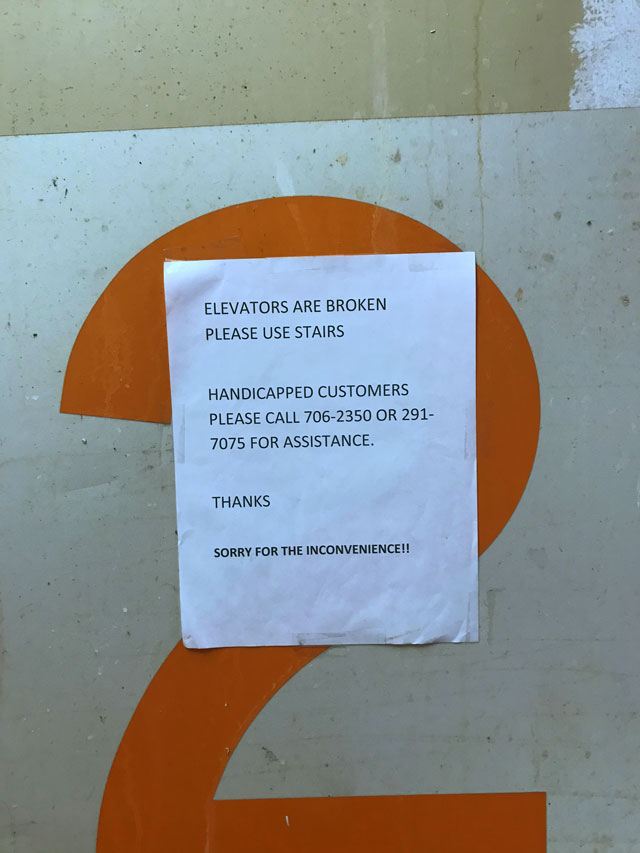

Why would the Parish sell a profitable asset to the City?After hearing that the Parish’s Buchanan Garage is terribly under-maintained because the parish lacks the funds to keep up, I decided to walk over and check it out. As it turns out, the whole place could use a good cleaning and a coat of paint. The elevators are out of service, but not because they’re broken. The city traffic engineer explained that the elevators were turned off out of an abundance of caution because the building needs a structural assessment.

Even so, vehicles are permitted to park anywhere in the garage, including the top floor. The reason an assessment has not yet been performed is not known at the moment. It’s possible the council would need to approve it, but I’ve not seen a Buchanan garage assessment in any meeting minutes going all the way back to January of 2017. A public records request submitted almost two weeks ago was acknowledged but the information has not arrived.

Has the City/Parish Council done anything about it?

The garage does appear in a few meetings. The March 21st meeting of 2017 introduced ordinance O-053-2017 to transfer $161,919 from various Buchanan Garage projects into a more broad Buchanan Garage improvement project. At the April 4th meeting, the transfer was unanimously approved by the council. The 2017-18 budget reflects this change on page 307. As of April 30th, 2017, the Buchanan Garage Improvement budget of $311,526 had a balance of $162,665. On page 255, the 2018-19 budget is unchanged, meaning nothing has been spent since the money was transferred.

Then, on July 10th, 2018, introductory ordinance O-112-2018 was filed to sell the parish garage to the city for $770,000. It was pulled by the administration at the July 24th, 2018, meeting. However, the $770,000 sale remains a part of the 2018-19 budget (page 61 and again on page 75).

What’s the Buchanan Garage’s financial situation?

Last year (2017) the garage spent 24% of its building maintenance budget. However, the year before (2016) they only spent 6%. In 2015 and 2014 they only spent 3%. All told, in the last four years, they’ve only spent 9% of their maintenance budget. Is it any wonder the garage is in poor condition? In the same period, if we eliminate utilities, they only spent 20% of the total budget. The numbers were $57,500 average annual budget versus 28,750 in spending. Utilities was $22,000 of that, leaving only $6,750 in average annual spending to keep up the entire facility.

I know what you’re thinking. They didn’t spend it because they didn’t have it. That theory doesn’t work, though, because the garage is an asset for the parish. It makes them more money than it costs to operate – a lot more. The average income from parking fees every year exceeds $90,000. So, even if the garage spent it’s entire budget, it would be operating at a profit margin of about 36%. However, because they’ve only been spending a fraction of that, they’ve been operating at a 69% profit margin. Last year it worked out to $90,626 in income (page 101) against expenses of $28,370 (page 184), profiting $62,256.

What’s next for the garage?

So how much does an assessment cost and who has to approve the expenditure? In a memo dated February 24, 2017, Warren Abadie said “an Architect will be contracted to prepare plans and specifications for the garage improvements that will include, but not be limited to structural, stairwell and elevator improvements.” We’re hopeful there is an architectural plan along with associated costs included in a response to our public records request. However, Mr. Abadie told me on the phone that, as yet, no assessment has been done.

Since money has been the stated concern at the City/Parish Council meetings, lets have a look at the numbers again. In the last four years, the garage has $30,000 left over from their maintenance budget, and $115,000 left over from their total budget. If we go back to 2009, there’s $173,000 in unspent money left over. Adding in their $161,919 maintenance budget, we’ve suddenly found $335,000 to make improvements. If it’s not enough to assess and revitalize the garage, it’s $62,000 in profit last year could potentially qualify them for $600,000 in bond money. That’s $935,000, which is more than the parish is asking for in the pending sale of the garage.

In conclusion, we believe that selling a money-making parish asset to the city should not be an option. We’ve explored ideas for financing any necessary maintenance or improvements. We’ve also identified that the bulk of the parish’s $105,376 general fund balance (page 47) is just a smidge more than the Buchanan Garage brings in every year. Allowing the Parish to sell this asset to the city can only exacerbate the Parish’s money problems.

###