Many regular readers will remember that the council introduced five new tax districts on November 19th. That was only THREE-DAYS after they were re-elected on November 16th. After all, they couldn’t very well have announced their intention to immediately raise your taxes without it impacting their re-election campaigns.

Many regular readers will remember that the council introduced five new tax districts on November 19th. That was only THREE-DAYS after they were re-elected on November 16th. After all, they couldn’t very well have announced their intention to immediately raise your taxes without it impacting their re-election campaigns.

In fact, the timing of all this was so precise that it wasn’t until the last half-hour of Joel Robideaux’s administration that these five new taxing districts were signed into law. My working theory: it managed to get councilmen re-elected who were friendly to the taxes while simultaneously preventing Josh Guillory, a staunch critic of these taxes, from vetoing them. An added bonus for the tax-and-spend councilmen is this setup blocks all executive oversight. That means they would be free to pass all the taxes they wanted, also without the possibility of veto. So far so good.

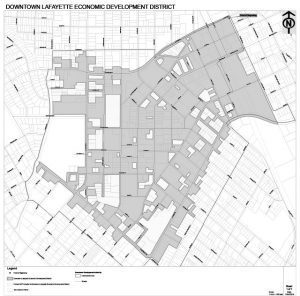

At the Downtown Development Authority (DDA) breakfast event of March 11th, Josh Guillory openly opposed what the DDA had done. That is, creating and levying a tax without a vote of the people. Their district was especially egregious, targeting businesses who don’t get a vote while eliminating voters who do. The result looked like Swiss cheese.

Manipulation

Not only did they have to gerrymander a district to avoid voters. They also had to cherry-pick a single sentence fragment from state law. Deep within Revised Statute 33:9038.33 A, that fragment reads, “…however, in the event that there are no qualified electors in the district … no election shall be required.” Whether or not this is constitutionally legal or allowed by the charter is a matter in controversy. That’s because this single statute says the same council who can’t levy taxes without a vote of the people, inexplicably has power to create a taxing district that can! For reference, Article 6, Section 29 in our state constitution, and Article 2, Section 17-D in Lafayette’s home rule charter specifically forbids the practice.

Also, in order to get this past enough individual council members, five more taxing districts were created. Liz Webb-Hebert even tried to raise taxes in her district at the Acadiana Mall. Perhaps the owner of the mall reached out and explained that raising taxes would accelerate the decline of their already shrinking business. Thanks to that lesson in economics, the Acadiana Mall tax idea was scrapped. However, the lesson wasn’t quite enough to scrap the other five. She and Nanette Cook still voted to levy taxes on the poorest citizens in town; and all in the name of “progress.”

Promises made, promises kept

Once seated as the new Mayor-President, Josh Guillory quickly followed all of the the proper procedures to get a series of new ordinances put on the City Council agenda. Those ordinances were to consider repeal of all five new taxing districts, one at a time. On February 21st, City Council Chairman, Pat Lewis, refused to even allow them on the agenda. This is rather shocking for a few reasons. The first of which is the repeal ordinances would likely have failed 4:1 anyway. The second is a little more complicated.

Hypocrisy reigns supreme

That the M-P was blocked from putting an item on the agenda shows the flagrant hypocrisy that permeates Lafayette Consolidated Government. On January 27th, our own Lydia Romero asked, by what authority Joel Robideaux, acting as Mayor-President (the executive branch of Lafayette’s government), is empowered to encroach on the legislative authority vested in the council? Her main point was adding pre-written ordinances to the agenda was, in fact, a form of legislating. That’s something the Home Rule Charter says only the Council may do. Here’s an excerpt from Lydia’s observations.

Section 2-01 states that “The legislative power of the City-Parish Government shall be vested in a Council.” Section 2-11 is titled “Action Requiring an Ordinance,” and 2-11, A states “An act of the Council having the force of law shall be by ordinance.”

Section 2-12 is titled “Ordinances in General,” and prescribes the process and requirements of introducing ordinances and final approval. From all this we understand that an ordinance is a legislative act.

It’s important to note: Section 2-13 states, “Every ordinance adopted by the Council shall be signed by the presiding officer or the Clerk of the Council…and it shall be presented to the Mayor-President…” From this we understand that the Mayor-President’s involvement with an ordinance occurs after it has been through the legislative process.

It was on February 4th that City-Parish Assistant Attorney, Mike Hebert, responded with a written opinion that the Mayor-President is within his rights to place items on the agenda. Lydia returned to her pen and wrote in detail about that reply when it happened.

However, by legal council allowing Pat Lewis’s block to stand, are we to assume that the attorneys are suddenly reversing course? Should we consider their silence as an agreement with Lydia? If this is allowed to stand, does that mean the M-P does not have the authority to place items directly onto the council agenda? Can we also assume anything added to the agenda by the M-P in previous years (such as the five new taxing districts) is illegal and should be struck down? Could repercussions from exposing such a long-unopposed but illegal practice under his watch be exactly why Mr. Hebert was forced to issue his opinion supporting it, but now remains silent?

Perhaps the logic is: the M-P has power to put ordinances on the agenda so long as he’s creating taxes. However, he has no power to do so to repeal them. What we’d really like to know from City-Parish Attorney, Greg Logan, is the opinion created by your employee, Mike Hebert, valid or not? If it’s valid, then by what authority was the M-P’s request blocked?

A tool for Mr. Guillory’s toolbox

Backed by OneAcadiana, LEDA, and even LCG’s Planning and Development Department, DDA’s surprise attack on an unwary population achieved an incredible feat. They created five brand new taxing districts in just twenty-eight days. We know they partnered together on this because in August of 2019 they all co-published their blueprint titled, “How We Compete.” If we turn to page five of that document, it describes in vivid detail the very same process they used to create these taxing districts. A regular reader may also remember FORMER Planning Director, Danielle Breaux’s digital fingerprints were found on the talking points memo. Ms. Breaux crafted that document to help uninformed council members defend the creation of five, new, long-term taxing districts thrust upon them at the last possible moment.

Within the ten-day challenge period, around December 28th, several local concerned citizens filed a lawsuit to slow things down. What many don’t realized is this lawsuit can be a powerful tool for the people of Lafayette, if it’s property wielded by Mayor-President Josh Guillory. That’s because the City-Parish attorneys answer directly to, and take their direction from, the administration: the Mayor-President’s office. Determining that a settlement is in the best interest of the people of Lafayette can be done at his sole discretion.

The residents of Lafayette, who’ve overwhelmingly rejected all attempts to have taxes foisted upon them, would applaud loudly. We know this, not just because one tax after another is destroyed at the polls, but also because of the call-ins to the Council’s office. When the districts came before the council on December 17, 2019, 103 residents called in opposition to all six, while only 21 called in support; a 5:1 ratio. When M-P Guillory said he was planning to put a repeal on the agenda, 106 called to support the move while only 6 called to oppose it. That’s nearly an 18:1 ratio.

What happens when the M-P decides to invoke his just powers?

The civilian lawsuit only asks that the Council restart the process and follow the notification guidelines as set forth in state law. Specifically, that they give ten-days notice for introduction and thirty-days notice on a final vote. The previous council couldn’t do this because, even with the lightning pace they set, they only managed to finish in the last half-hour of their existence (and at an emergency meeting, no less). Their determination to ram these districts through at any cost has added a distinct aura of corruption to the whole process. In short, it stinks. However, the new council has nearly four years to accomplish anything it wishes, and it has the votes to pass it again. Starting over shouldn’t be a problem.

If the M-P follows popular opinion and orders the process to begin anew, the most likely scenario is fairly easy to sketch. The people with their hands out would have to wait a little longer while the process inevitably arrived at the same conclusion. Of course the council members would have to endure another 40-days of answering questions like, how, exactly, do these districts benefit the city? Considering how unpopular they are, it’s no surprise that the council would prefer to just move on and never speak of this again.

The council votes again

When Mr. Guillory restarts the process, the council would likely follow the same path that it did previously, enevidlably arriving at the same outcome. That is, authorizing the districts to perform an action that the council itself cannot: to levy taxes without a vote of the people. We know Pat Lewis, Nanette Cook, Liz Hebert, and Kenneth Boudreaux’s friend Glenn Lazard all support it. The only predictable opposition would be Andy Naquin‘s good sense. However, it’s just possible that, knowing that only three votes are required for passage, one member would be permitted to vote against it for appearances; or a late flight would preclude them from voting. That’d make the margin of victory a tighter 3:2 or 3:1.

What would be different this time is having to face a guaranteed veto. While only three members are required to create the district, a veto override takes four. Late flights notwithstanding, all four members would have to show up at the meeting and vote together. It would be an interesting exercise to discover if Liz and Nanette could hold the line against the withering opposition from their constituents, or if one would succumb to the pressure.

###

We’re the only organization holding them accountable.

Our deep research takes a tremendous amount of time and resources. After reading this article, you can probably understand why the government isn’t funding our work. In fact, they probably wish we’d just go away. That’s why we depend on the generosity of concerned citizens like you.

We’re seeing a record number of new monthly contributors and one-time donors. These are people just like you. They’re tired of the local news constantly regurgitating government press releases, pushing higher taxes and lower expectations. Are you one of them? Join us now.

Trackbacks/Pingbacks